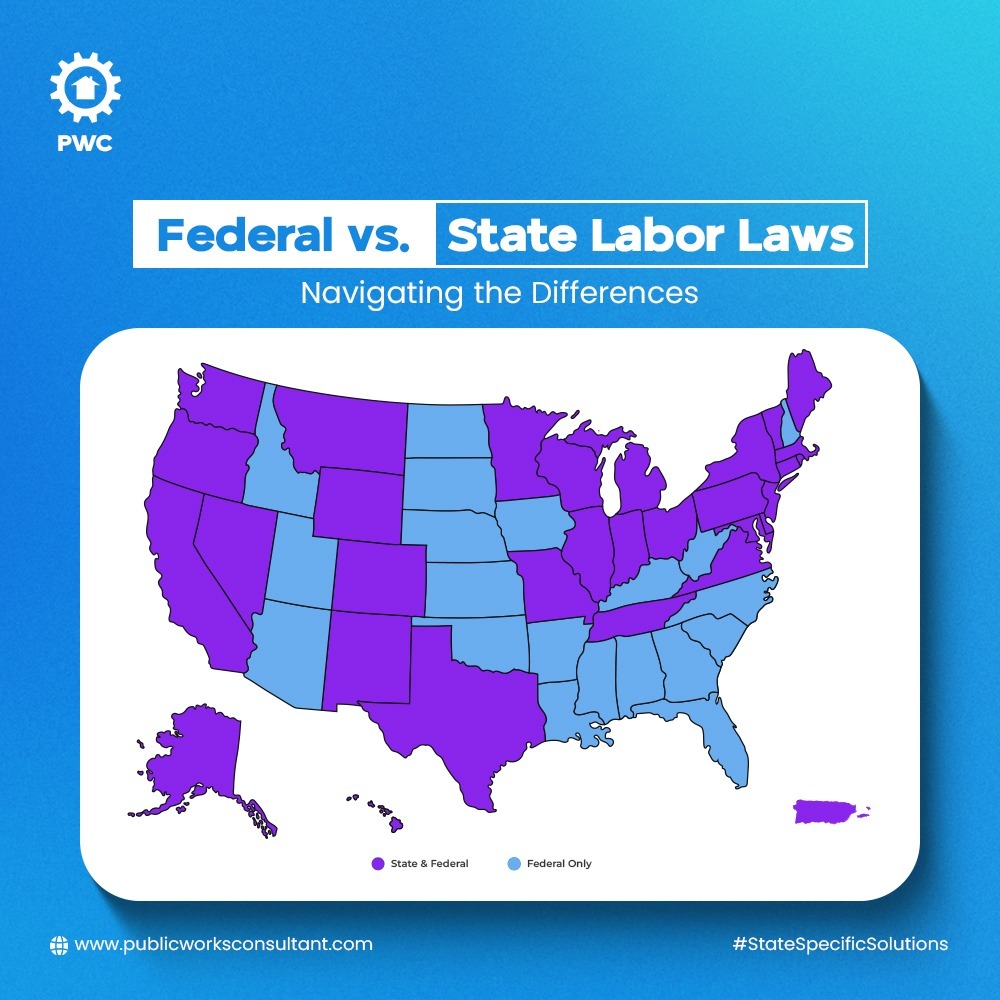

Oregon Certified Payroll

Helping Oregon Contractors Stay Compliant & Win More Public Works Contracts

Washington Certified Payroll

Helping Washington Contractors Secure More Public Works Contracts

California DIR Certified Payroll

Helping California Contractors Stay DIR-Compliant & Win More Public Works Projects